IJsbrand Uljée

Senior Associate | Tax advisor

Send me an e-mail

+ 31 (0)20 333 8390

On 6 December 2022, the Dutch State Secretary of Finance published a Decree clarifying the application of Dutch anti-hybrid rules of the Dutch dividend withholding tax act 1965 and the withholding tax act 2021. The Decree describes the application of the Dutch anti-hybrid rules in a particular Dutch – US corporate structure. At the same time the Decree of March 19, 1997, IFZ/204M was repealed.

Background

In practice there was some ambiguity on which party should be treated as the ‘beneficiary of the income’ in the case of payments made by a Dutch entity (withholding tax agent) which is disregarded for non-Dutch tax purposes to another disregarded entity for non-Dutch tax purposes. This ambiguity in particular occurs in the situation where a Dutch withholding tax agent (from a Dutch tax perspective) performs a payment to a hybrid entity, for instance as a result of a check-the-box election in the US. It is relevant to determine the beneficiary of the income in order to assess the application of the Dutch dividend withholding tax exemption and the non-application of withholding tax on interest and royalties.

The anti-hybrid rules: example

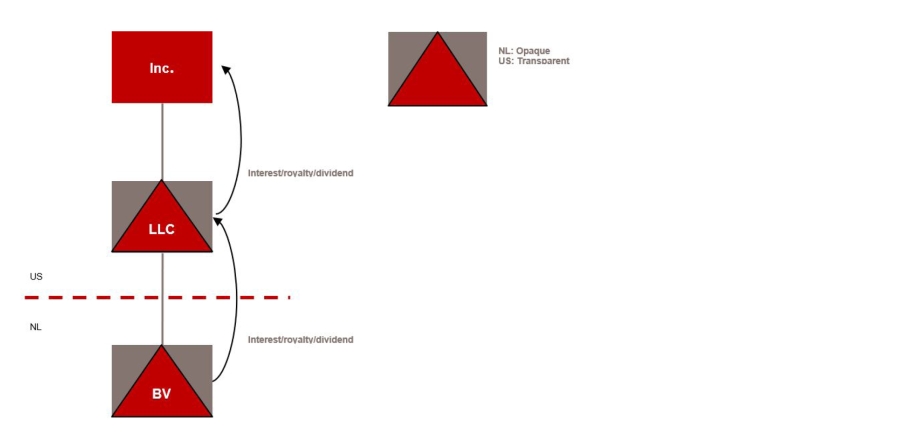

The Decree describes the following Dutch – US corporate structure. An entity incorporated under the laws of the US, tax resident of the US and fully subject to corporate income tax in the US (Inc.) holds all shares in a US hybrid entity (LLC). The LLC is treated as transparent for US tax purposes. However, the LLC is treated as opaque for Dutch tax purposes. The LLC holds all shares of a Dutch limited liability company (BV). Based on the US check-the-box election, the BV is treated as a disregarded entity for US tax purposes. The corporate structure can be depicted as follows:

The BV pays dividend, interest and/or royalties to the LLC. For Dutch tax purposes, the LLC is in principle considered the beneficiary since both the LLC and BV are treated as opaque for Dutch tax purposes. Since the BV and LLC are treated as transparent for US tax purposes, only the Inc. exists from a US tax perspective. The payment of dividend, interest and royalties is therefore disregarded for US tax purposes. The (underlying) profit of the BV is included in the taxable profit of the Inc.

Application hybrid entity rules

In the above example, the Inc. can be regarded as the ‘beneficiary of the income’ for Dutch tax purposes provided that the Dutch withholding agent reasonably proves that the income from which the payment of dividend, interest and royalties have been made, is taken into account on the level of the underlying participant(s). For this purpose, the tax return of the Inc can be used if it shows that the (underlying) income of the Dutch entity is allocated to the opaque US entity. This interpretation also applies if there is a stacking of hybrid entities. It is irrelevant whether the underlying income will be taken into account as taxable income with the underlying participant(s) in the year of the payment of the dividend, interest or royalty or in an earlier year.

Follow us!

Subscribe newsletter LinkedIn