Martijn Vermeeren

Managing Partner | Lawyer

Send me an e-mail

+31 (0)70 318 4200

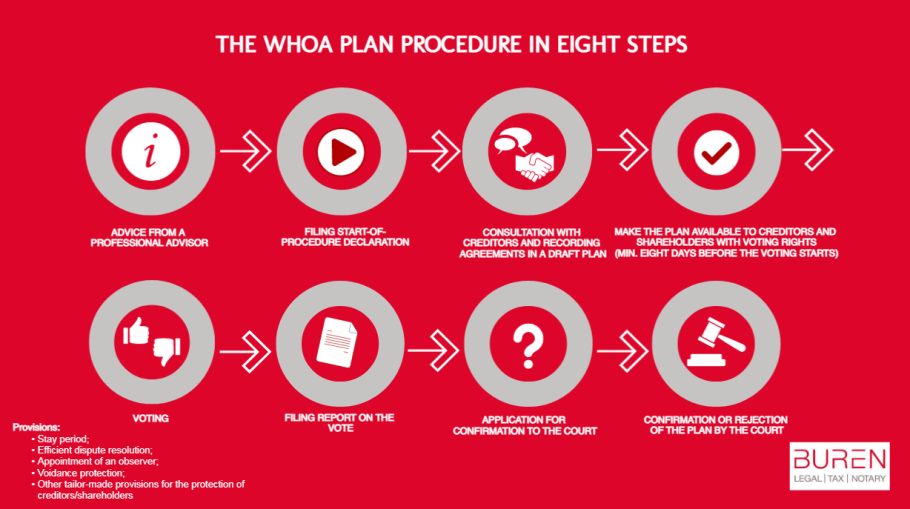

On January 1, 2021, the Act on the Confirmation of Private Plans (the Dutch Scheme or WHOA, its Dutch acronym) came into effect in the Netherlands. The WHOA is an important tool for companies and businesses to avoid a suspension of payments or bankruptcy by restructuring its capital structure (equity and debt) through a private plan. However, the WHOA can also be used to wind up business activities in a controlled manner via a liquidation plan.

The WHOA offers a statutory basis for a plan outside insolvency where shareholders and creditors or a subset of them, can be bound, even if they vote against the plan. As this may sometimes have far-reaching consequences, the Dutch Scheme sets out the procedures, safeguards and rules with which plan procedures must comply.

The WHOA is quite extensive and offers various possibilities for offering a tailor-made agreement. On this WHOA page we will use questions and answers to inform you about the main aspects and issues you may face as a director, shareholder, creditor or other stakeholder.

If you would have any question or would need any advice regarding the Dutch Scheme, please feel free to contact us. We will be happy to assist you.

Managing Partner | Lawyer

Send me an e-mail

+31 (0)70 318 4200

Partner | Lawyer

Send me an e-mail

+31 (0)70 318 4200

Senior Associate | Lawyer

Send me an e-mail

+31 (0)70 318 4200

Senior Associate | Lawyer

Send me an e-mail

+31 (0)70 318 4200