08-04-2024

Corporate Social Responsibility Directive (CSRD)

The Corporate Social Responsibility Directive (CSRD), an EU legislation, requires large companies to disclose non-financial and diversity information in their annual reports, including environmental matters, social and employee-related aspects, respect for human rights, and anti-corruption issues. The goal of the directive is to provide stakeholders, such as investors, analysts, consumers, EU companies’ sustainability performances and other business impacts or risks. As part of the European Green Deal and EU Action Plan for Financing Sustainable Growth, the directive improves the private sector’s transparency and accountability around ESG impacts and risks to promote sustainable economic growth and investment in the EU.

Obligations

- European Sustainability Reporting Standards (ESRS) outlines reporting metrics and requirements under the CSRD. There are 12 ESRS categories spanning sustainability matters grouped into cross-cutting, environmental, social, and governance aspects.

- Double Materiality principle underlies the execution of the directive; it requires companies the identification of both the impacts of business on people and environment (impact materiality) and how the business’s sustainability goals, measures, and risks impact the undertaking’s financial health.

- These disclosures will have to be publicly available and the CSRD requires a third-party audit on the disclosed information.

Applicability and Conditions

Applicability is differentiated by three categories;

- Listed undertakings: Companies listed on EU regulated market exchange (except for “micro undertakings” that doesn’t meet two of the three criteria)

- +EUR 450,000 in total assets

- +EUR 900,000 in net turnover

- + 10 employees

- EU-based large undertakings (regardless of listed) – meeting two of the three criteria

- +EUR 25 million in total assets

- +EUR 50 million in net turnover

- + 250 employees

- Third Country undertakings – including non-EU parent companies of EU subsidiaries, with annual EU revenues of +EUR 150 million in the last two years and possess:

- Large EU-based undertaking, or

- EU based subsidiary with securities listed on EU-regulated market exchange, or

- EU branch office with +EUR 40 million net turnover.

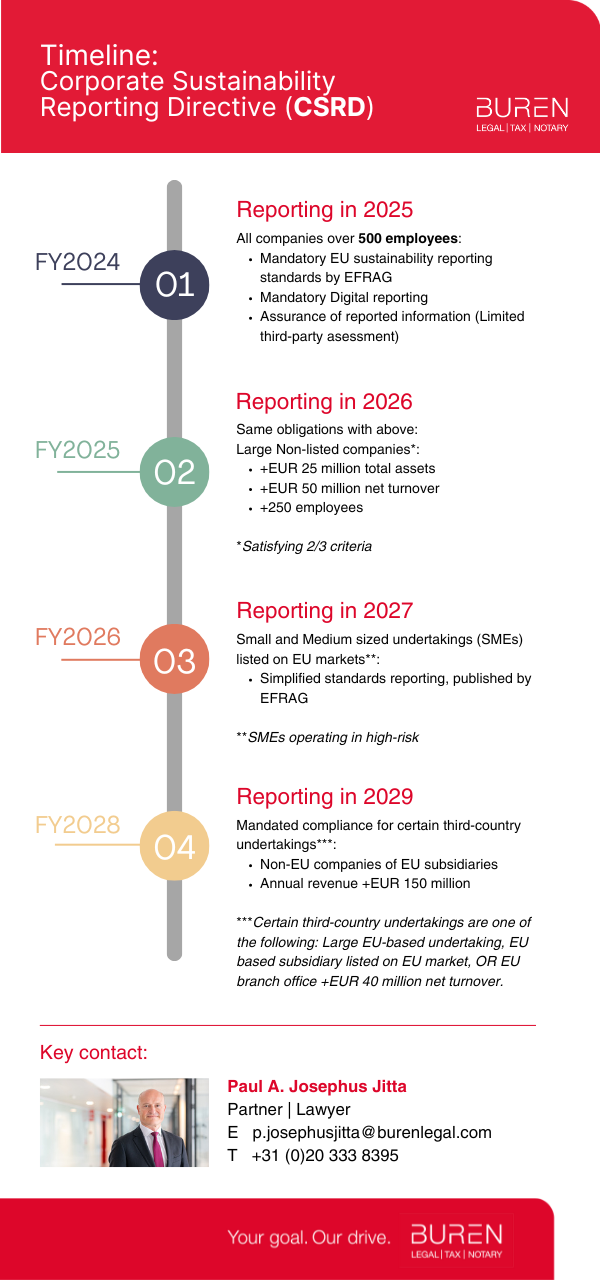

CSRD Timeline

The directive is effective from January 5th, 2023, and will be transposed within member states by 6 July, 2024.

- Financial Year 2024 (Reporting in 2025): Mandated compliance for undertakings listed on EU-regulated markets with +500 employees, which were already mandated under the NFRD.

- Financial Year 2025 (Reporting in 2026): Mandated compliance for large undertakings meeting the employee threshold but not previously required to comply with the NFRD.

- Financial Year 2026 (Reporting in 2027): Mandated compliance for small and medium-sized undertakings (SMEs) listed on EU-regulated markets.

- Financial Year 2028 (Reporting in 2029): Mandated compliance for certain third-country undertakings.

See below for an overview. The timeline is also available as download: CSRD timeline